GST Calculator

Calculate GST amount instantly

Tax Breakdown

* For intra-state transactions. IGST applies for inter-state transactions.

GST Calculator: Calculate GST Instantly, Accurately, and Effortlessly.

Accurately calculating taxes is crucial for businesses, independent contractors, students, and regular consumers in today’s fast-paced digital economy. Due to various tax slabs, inclusive and exclusive pricing, and various components like CGST, SGST, and IGST, the Goods and Services Tax (GST) can occasionally be confusing. This is the point at which a GST calculator becomes a crucial online resource, assisting users in quickly and accurately calculating tax values.

A modern online GST calculation tool is designed to simplify tax computation while ensuring accuracy and transparency. Whether you are preparing invoices, checking purchase costs, or understanding tax liabilities, using an online calculator saves time and reduces mistakes.

What Is GST?

GST (Goods and Services Tax) is a unified indirect tax system applied to the supply of goods and services. It replaces multiple indirect taxes, such as VAT, service tax, and excise duty, with a single tax structure. GST is applied at different rates depending on the type of goods or services, commonly including 5%, 12%, 18%, and 28%.

Understanding GST calculations manually can be difficult, especially when switching between inclusive and exclusive pricing. That’s why an automated solution is preferred.

What Is a GST Calculator?

A GST calculator is a web-based application that allows users to calculate GST amounts automatically based on the entered value and selected tax rate. It instantly shows the tax amount and final price, helping users avoid complex formulas and manual calculations.

This tool works for both GST-inclusive and GST-exclusive amounts and clearly breaks down tax components for better understanding. It is useful for individuals, businesses, accountants, and students alike.

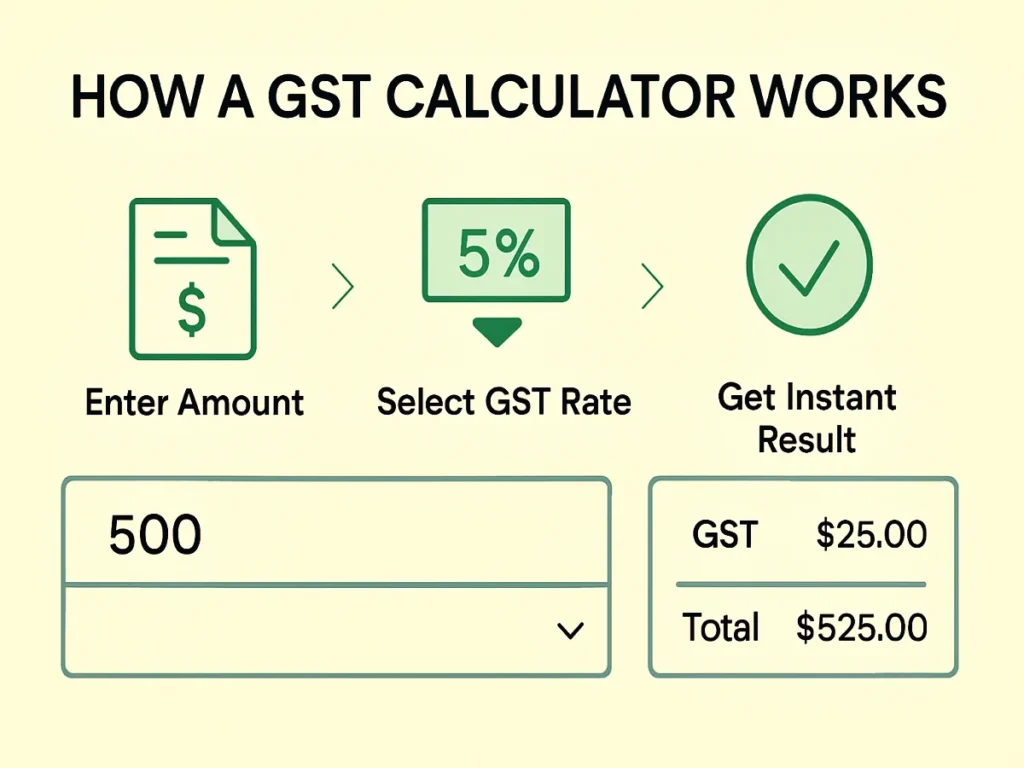

How the GST Calculator Works

Using a GST calculator is extremely simple and user-friendly:

- Enter the original amount (price of goods or services).

- Choose if the sum includes or excludes GST.

- Choose the applicable GST rate (5%, 12%, 18%, or 28%).

- Instantly view the GST amount and total payable value.

The tool processes the calculation in real time, delivering accurate results without delays.

Key Features of the GST Calculator

A high-quality GST calculator offers several useful features:

1. Instant GST Calculation

Results are displayed immediately after entering values, saving time and effort.

2. Inclusive and Exclusive GST Support

Users can calculate GST from both tax-inclusive and tax-exclusive prices.

3. Accurate Tax Breakdown

The calculator provides a clear breakdown of GST components such as CGST, SGST, or IGST when applicable.

4. Multiple GST Rates

Supports all standard GST slabs, making it suitable for different goods and services.

5. User-Friendly Interface

Designed for simplicity, allowing anyone to calculate GST without technical knowledge.

6. No Registration Required

The tool can be used instantly without signing up or logging in.

Benefits of Using an Online GST Calculator

Using an online GST calculator offers several advantages:

- Time-saving: No need for spreadsheets or manual formulas

- Reduces Errors: Ensures accurate tax computation every time

- Improves Transparency: Clear visibility of tax amount and final cost

- Boosts Productivity: Ideal for businesses handling multiple invoices

- Accessible Anywhere: Compatible with tablets, smartphones, and desktop computers

For professionals and businesses, accurate GST calculations help in proper invoicing and compliance.

Who Should Use a GST Calculator?

A GST calculator is useful for a wide range of users:

- Business Owners: For invoice generation and pricing decisions

- Freelancers: To calculate GST on services offered

- Accountants: For quick verification of tax amounts

- Students: To understand GST concepts practically

- Consumers: To check the tax included in product prices

No matter your profession, this tool simplifies tax calculations.

GST Inclusive vs. GST Exclusive Explained

Understanding the difference is crucial when using a GST calculator:

- GST Exclusive: GST is calculated separately and added on top of the original base price.

- GST Inclusive: GST is already included in the final price.

The calculator automatically adjusts formulas based on your selection, ensuring accurate results in both cases.

Why Accuracy Matters in GST Calculation

Even minor calculation mistakes can cause compliance problems, inaccurate invoices, and financial mismatches. A reliable GST calculator removes uncertainty by applying accurate formulas and correct tax rates, ensuring consistent and precise results for every transaction.

SEO and Business Use Cases

For online sellers and service providers, using a GST calculator helps ensure correct pricing on websites, invoices, and quotations. It also supports transparent communication with customers by clearly showing tax amounts.

Accurate tax calculation builds trust and helps maintain professional credibility.

Frequently Asked Questions (FAQ)

What is a GST calculator used for?

A GST calculator is used to calculate the GST amount and final price of goods or services based on selected tax rates.

Is the GST Calculator free to use?

Yes, this GST calculation tool is completely free and does not require registration.

Can I calculate GST-inclusive and exclusive prices?

Yes, the GST Calculator supports both inclusive and exclusive GST calculations.

Which GST rates are supported?

The tool supports common GST slabs such as 5%, 12%, 18%, and 28%.

Is this calculator suitable for businesses?

Absolutely. Businesses can use the GST Calculator for invoicing, billing, and tax estimation.

Does it calculate CGST and SGST separately?

Yes, depending on the transaction type, the calculator can show CGST and SGST or IGST.

Can students use this tool?

Yes, students can use the GST Calculator to learn and practice GST calculations easily.

Is the calculation accurate?

The calculator uses standard GST formulas to ensure accurate and reliable results.

Can I use it on mobile devices?

Yes, the GST Calculator is fully responsive and works on all devices.

Do I need accounting knowledge to use it?

No, both novices and experts can use the tool.

Concluding Remarks

Anyone working with goods and services under the GST system needs a trustworthy GST calculator. It saves important time, lowers errors, and simplifies complicated computations. This web application enables you to compute GST fast and precisely, regardless of whether you are a consumer, freelancer, business owner, or student.

This tool makes GST easy and stress-free by giving you control over your tax calculations, clarity, and confidence.